Make "tomorrow you" pay....

Over at the Social Economics Blog, there was a discussion on "Starving the Beast" by cutting taxes and creating deficits that would require either (a) cutting future spending or (b) making future generations pay for it.

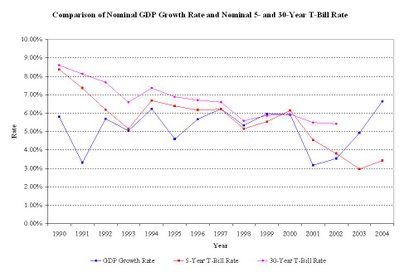

It was suggested that one possible motivation for such a time-inconsistent policy is that due to economic growth, future generations would be better suited to handle paying the tax burden (i.e. they would be richer and thus able to handle it). The graph above plots the list 15 years of data of GDP growth rates and the annual average of monthly 5- and 30-Year Treasuty Bill rates (i.e. one measure of the interest rate paid on government debt). As you can see, only recently has the growth of GDP been higher than interest rate paid on debt, so it doesn't seem like that rationale holds any water.

Edited to add: Greg Mankiw makes the argument that future generations would be better suited to handle paying the burden:

Because of technological progress, the income and consumption of a typical individual in the economy rises over time. Because budget deficits shift taxes forward in time, they benefit relatively poor current taxpayers at the expense of relatively rich future taxpayers. If reducing inequality is a goal of policy, shouldn’t budget deficits be applauded?(Emphasis added.)

One way to answer this question is to go beyond neoclassical economic theory. Although standard models assume that people desire to smooth consumption evenly over time, popular discussions of economic policy presume that consumption should rise over time. Politicians often assume a moral imperative that the current generation sacrifice to ensure that future generations enjoy a substantially higher standard of living. This view suggests that it is undesirable to shift a tax burden onto our children, even though our children will be better able to shoulder that burden than we are.

I don't see how this argument holds water. That said, the rest of Mankiw's post seems much more reasonable to me.

(Note: Data is from St. Louis Fed and NIPA. T-Bill Rates are *not* inflation indexed rates. Data does not exist for 30-Year T-Bills between 3/2002 and 1/2006.)

1 Comments:

as with any political policy "tax cuts" is a language that disguises the motive or less sinisterly the effect. As we came out of the recession of the 80's. We realized, or at least non-political lay people, that trickle-down economics doesn't work. if you give tax cuts coupled with unregulated markets, the corporations have no fiscal incentive to spend. Innovation, standard of living and many other social benchmarks decline. So in this new paranoid fiscal enviornment they are trying it again. This time masked in the language of economic stimulation. Because more people have investments (401k,mutual funds ect.) when the market indicators show incline, they can show emperically that the strategy works. But under more scrupulous investigation of the numbers that matter we see real wages going down. while corporations are showing record profits (even adjusted for inflation). So when you look at policy you have to have telescopic vision. You must see actual effect and who benefits.

Post a Comment

<< Home